Wollert's primary population has almost doubled since 2019 and is projected to be nearly 61,000 by 2036.

Data Source: ABS; .idcommunity

Target EIRR: 18.77% p.a.

(net of fees, pre-tax)

Development in Progress

Closed for Investment

*Some uses are subject to council approval (STCA).

The images shown are artist’s impressions, designed to illustrate the vision and architectural intent of the development. Final finishes, landscaping, and details may vary.

MODE Wollert is designed to meet the growing demand for high-quality commercial and industrial spaces in Melbourne’s norther growth corridor. This premium business park will feature units with essential amenities, catering for diverse activities such as warehousing, offices, large-format retail, trade supplies, and food services.

As the Wollert Precinct Structure Plan continues to roll out, the region is forecast to support more than 8,000 new jobs, reinforcing demand for industrial, retail, and essential services. Maximise is pleased to be contributing to the on-going development and economic prosperity of Wollert.

Hume Freeway

Melbourne CBD

Melbourne Airport

Data Source: ABS; .idcommunity

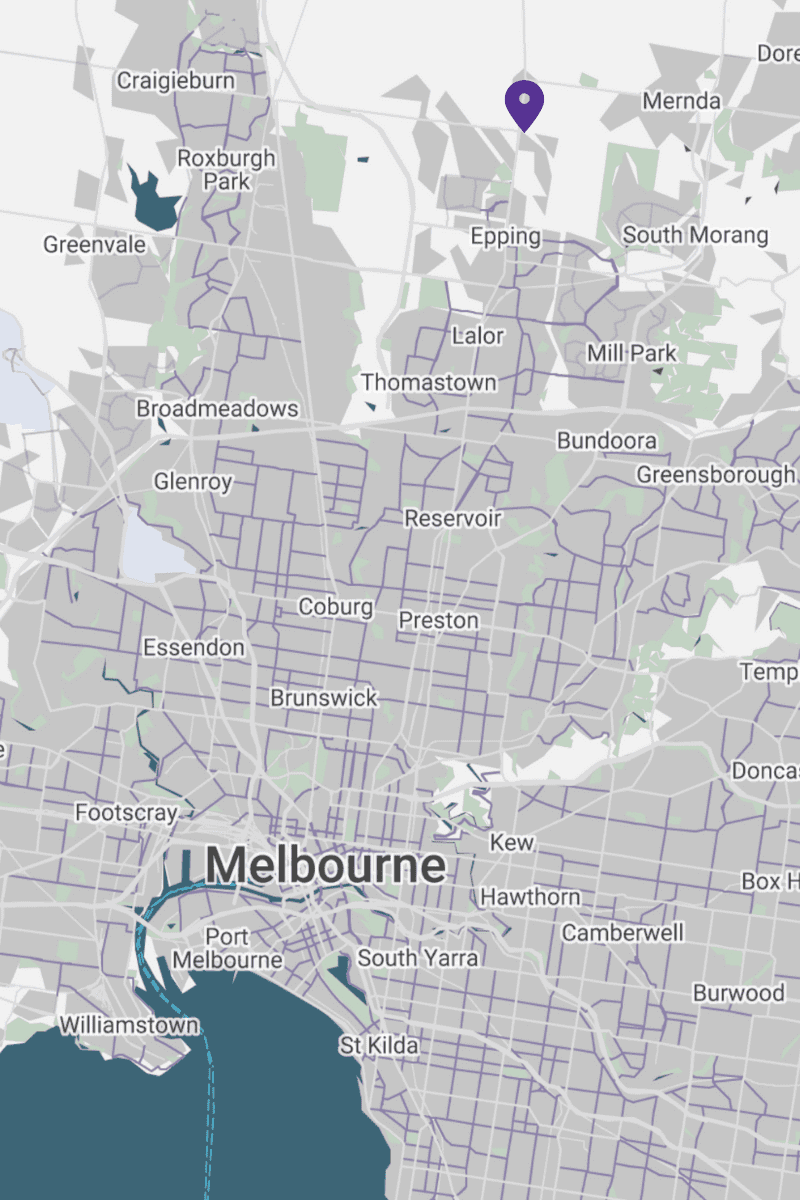

Located approximately 24 kilometres from the CBD, the local population has more than doubled since 2019, rising from around 17,000 to over 33,000 residents in 2024. Population size is expected to surpass 61,000 by 2036, driven by ongoing greenfield development and sustained housing demand. The area is characterised by young families, larger household sizes, and a high rate of home ownership. These are strong factors that contribute to long-term stability and local retail spending. As the Wollert Precinct Structure Plan continues to roll out, the region is forecast to support more than 8,000 new jobs, reinforcing demand for industrial, retail, and essential services.

Despite this growth, Wollert remains undersupplied in key property types that support local amenity and employment. Independent research by Urbis has identified clear gaps in supermarket, quick service restaurant and large format retail offerings with existing infrastructure falling short of current and future demands. The precinct also faces a shortage of developable industrial land, limiting opportunities for local businesses to establish or expand. The Fund is strategically positioned to respond to these unmet needs through the development of 91 warehouse units, 15 restricted retail tenancies, and three superlots suited to supermarket and food operators. With high visibility, excellent arterial access, and close proximity to a rapidly growing residential base, the Fund offers a compelling opportunity underpinned by real demand and a delivery model focused on strong investor outcome

*Source: ABS; Urbis