Moorabbin Industrial Precinct: Strong Demand Meets Limited Supply

With excellent connectivity, an affluent catchment, and persistent undersupply of small-format facilities, the Fund presents a compelling investment case.

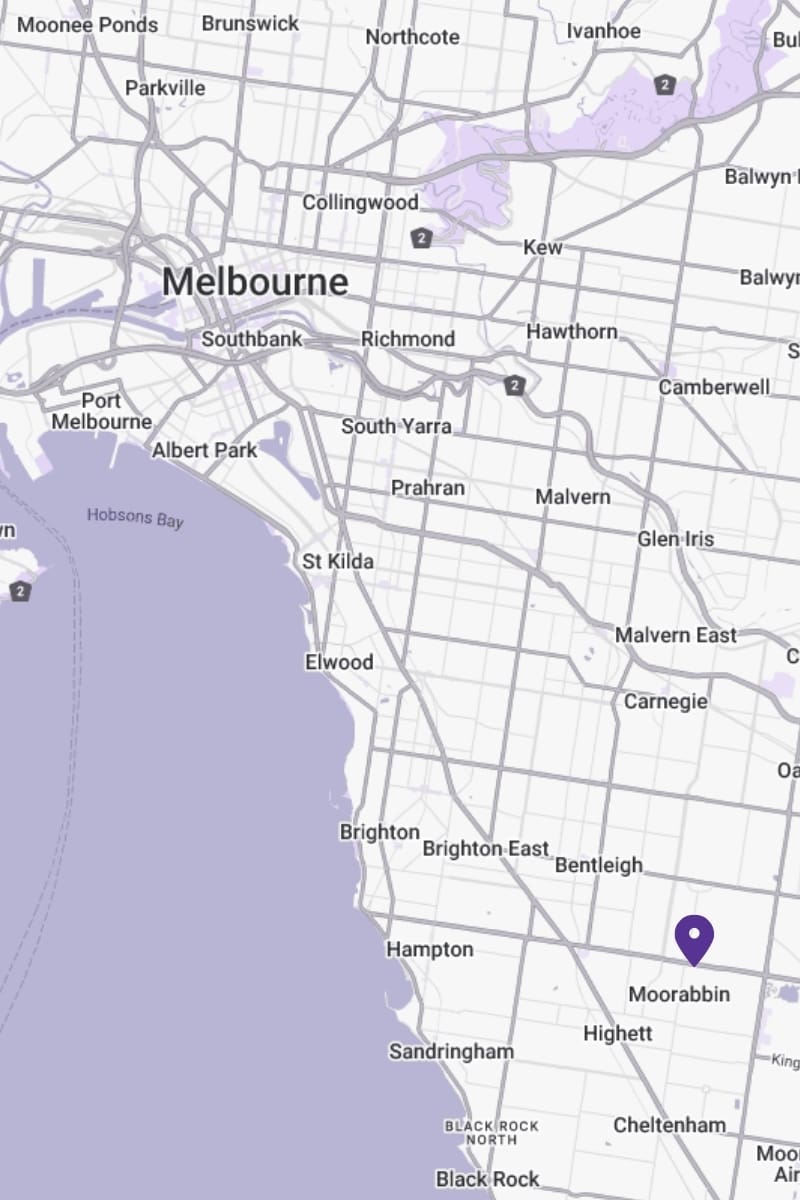

Moorabbin is recognised as a regionally significant industrial location within the City of Kingston, approximately 17 kilometres south east of Melbourne’s CBD. The area benefits from strong arterial connectivity and will gain further advantages from the Suburban Rail Loop East at Cheltenham, just one kilometre to the south.

The surrounding suburbs are among Melbourne’s most affluent, characterised by higher-income households and a relatively older demographic profile. The location also provides access to a sizeable workforce of about 132,500 people with strong representation in manufacturing and construction related sectors. Between 2019 and 2024, local business counts rose from 32,260 to 36,920, reflecting the expansion of smaller enterprises in retail trade, transport, and service related

industries*.

Independent research by Urbis highlights an acute undersupply of small-format industrial facilities in Moorabbin. This research is further reinforced by three independent real estate agencies confirming comparable developments are achieving rates above $5,000 per metre . Growing demand from smaller enterprises and owner-occupiers is set against tightly held land and a limited pipeline of new projects in the south-east corridor.

Recognising this opportunity, Maximise completed extensive due diligence to confirm the site’s suitability including engaging independent specialists covering more than 15 property development disciplines. The combination of strong demand, limited supply, and extensive risk assessment positions the Maximise FMI Moorabbin Fund as a high-quality investment opportunity within one of Melbourne’s most established industrial corridors.

*Source: ABS; Urbis